About Palau Chamber Of Commerce

Table of ContentsThe Palau Chamber Of Commerce IdeasPalau Chamber Of Commerce Fundamentals ExplainedGet This Report on Palau Chamber Of CommerceThe Facts About Palau Chamber Of Commerce RevealedThe Of Palau Chamber Of Commerce8 Simple Techniques For Palau Chamber Of CommercePalau Chamber Of Commerce for BeginnersNot known Details About Palau Chamber Of Commerce

As a result, not-for-profit crowdfunding is grabbing the eyeballs these days. It can be used for specific programs within the company or a basic donation to the cause.Throughout this action, you may intend to consider turning points that will certainly show an opportunity to scale your nonprofit. As soon as you have actually operated for a little bit, it's important to spend some time to think of concrete growth goals. If you have not already created them throughout your preparation, create a collection of crucial performance indications and also landmarks for your not-for-profit.

Unknown Facts About Palau Chamber Of Commerce

Resources on Beginning a Nonprofit in numerous states in the United States: Beginning a Not-for-profit Frequently Asked Questions 1. Exactly how a lot does it cost to start a nonprofit company?

How Palau Chamber Of Commerce can Save You Time, Stress, and Money.

With the 1023-EZ form, the handling time is generally 2-3 weeks. Can you be an LLC and also a not-for-profit? LLC can exist as a nonprofit restricted liability business, however, it ought to be completely owned by a solitary tax-exempt nonprofit organization.

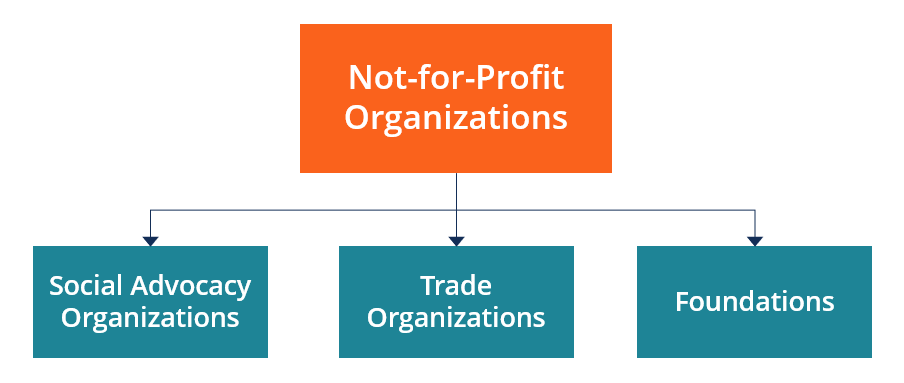

What is the distinction in between a structure as well as a nonprofit? Foundations are typically moneyed by a household or a company entity, but nonprofits are moneyed via their revenues and fundraising. Structures usually take the cash they began out with, spend it, and afterwards disperse the cash made from those financial investments.

Unknown Facts About Palau Chamber Of Commerce

Whereas, the added cash a nonprofit makes are made use of as running costs to fund the company's mission. Is it difficult to begin a not-for-profit company?

Although there are numerous actions to start a not-for-profit, the barriers to entry are reasonably couple of. 7. Do nonprofits pay taxes? Nonprofits are excluded from federal revenue taxes under area 501(C) of the IRS. There are certain Website scenarios where they might require to make payments. If your not-for-profit gains any revenue from unassociated activities, it will owe earnings tax obligations on that amount.

Getting The Palau Chamber Of Commerce To Work

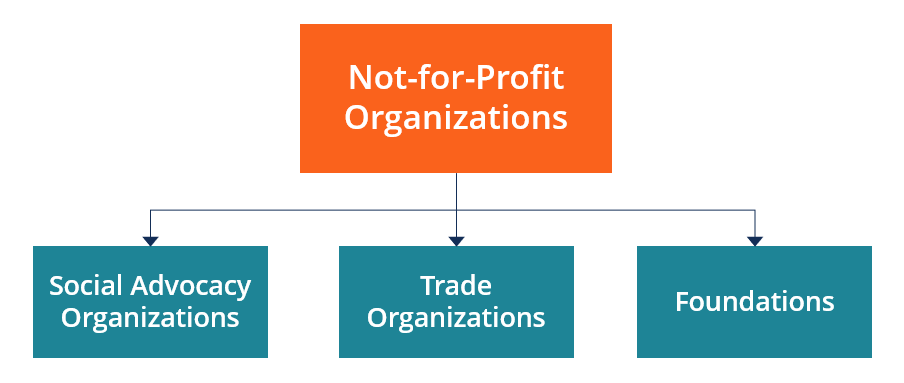

Twenty-eight various kinds of nonprofit companies are identified by the tax legislation. Yet by much the most typical kind of nonprofits are Section 501(c)( 3) organizations; (Section 501(c)( 3) is the component of the tax obligation code that authorizes such nonprofits). These are nonprofits whose goal is philanthropic, spiritual, instructional, or clinical. Section 501(c)( 3) company have one huge benefit over all other nonprofits: contributions made to them are tax obligation deductible by the donor.

The Best Strategy To Use For Palau Chamber Of Commerce

The lower line is that personal foundations get much even worse tax obligation treatment than public charities. The major difference in between exclusive foundations and public charities is where they get their economic assistance. A private foundation is typically managed by an individual, family, or company, and obtains the majority of its earnings from a few benefactors and financial investments-- an excellent instance is the Expense and also Melinda Gates Structure.

The Facts About Palau Chamber Of Commerce Uncovered

The majority of foundations just give cash to various other nonprofits. As a functional issue, you need at least $1 million to start a personal structure; or else, it's not worth the trouble as well as expenditure.

Other nonprofits are not so lucky. The IRS initially assumes that they are personal structures. Nonetheless, a brand-new 501(c)( 3) organization will be categorized as a public charity (not an exclusive structure) when it makes an application for tax-exempt standing if it can reveal that it sensibly can be anticipated to be openly supported.

Fascination About Palau Chamber Of Commerce

If the internal revenue service classifies the nonprofit as a public charity, it keeps this condition for its initial 5 years, no matter the public support it in fact obtains during this time. Palau Chamber of Commerce. Beginning with the nonprofit's 6th tax obligation year, it must reveal that it meets the public assistance test, which is based on the support it receives throughout the current year and also previous four years.

If a not-for-profit passes the test, the internal revenue service will remain to monitor its public charity condition after the first five years by needing that a completed Arrange A be submitted annually. Palau Chamber of Commerce. Learn more regarding your nonprofit's tax condition with Nolo's publication, Every Nonprofit's Tax obligation Overview.